2025 Housing Market Predictions

2025 Housing Forecast: What Buyers, Sellers & Renters Can Expect

As we move into 2025, the U.S. housing market finds itself at a crossroads, influenced by a new political landscape and an evolving economic climate. With President-elect Donald Trump returning to the White House after the 2024 election, markets anticipate a mix of familiar policies—such as tax cuts, deregulation, and business-friendly initiatives—and new uncertainties. Add to this the lasting aftershocks of the pandemic-era housing boom, ongoing affordability challenges, and shifting demographic trends, and you’ve got a complex, yet potentially more balanced, real estate environment on the horizon.

Below, we break down key forecasts from trusted industry sources like Realtor.com® and Redfin, and discuss how these changes could shape the market in 2025.

1. Home Prices: A Slower, Steady Rise

- Realtor.com® projects a 3.7% price increase in 2025, down slightly from 2024’s 4% growth. Redfin anticipates a roughly 4% rise. While that’s slower than the double-digit price hikes of the pandemic years, it still means homeownership remains a challenge for many.

- Higher listing inventory (up 11.7% per Realtor.com®) should curb sky-high appreciation. More sellers will enter the market—especially those in their 30s and 40s—diluting some upward pressure on prices. But don’t expect prices to fall; demographic demand and limited new construction will keep values climbing.

2. Mortgage Rates Near 6–7%: A New Normal

- The days of ultra-low mortgage rates are gone. Realtor.com® forecasts an average 6.3% rate for 2025, ending the year at about 6.2%.

- Redfin’s outlook is slightly more pessimistic, expecting rates to remain near 7%, barring a weaker economy or scaled-back tariff/tax-cut plans from the Trump administration.

- Even if incomes rise or taxes fall under new policies, the combination of modestly higher rates and steady price growth ensures affordability stays a top concern.

3. Sales Volume: Pent-Up Demand Fuels a Modest Increase

- After a challenging 2024, home sales could rise between 1.5% (Realtor.com®) and as much as 9% (Redfin) compared to 2024.

- This uptick is due partly to pent-up demand. Some buyers who sat out in recent years may jump back in if mortgage rates dip, even slightly.

- Expect unevenness: If mortgage rates stay stubbornly high, the sales bump will be modest. A surprise dip in rates or stronger-than-expected economic growth could push more buyers to act, bolstering sales.

4. Inventory on the Rise—But Still Below Pre-Pandemic Levels

- Realtor.com® expects for-sale inventory to climb another 11.7% in 2025 after a big jump in 2024. More sellers entering the market, plus a steady trickle of new construction, will help.

- Even so, inventory will remain about 23% below pre-2020 averages. While it won’t be a buyer’s paradise, it could be the most balanced market since 2016, giving buyers more time and options than they’ve had in years.

5. Rents Flatten as Multifamily Supply Surges

- Renters get a rare advantage as rental prices stay roughly flat, a marked slowdown from previous years. Newly completed multifamily projects add supply, providing tenants with more choices and potentially pushing landlords to offer concessions.

- With wages on the rise, renting becomes more affordable relative to buying in many markets—particularly in the South, where new units are going up at a steady clip.

6. Construction & Regulatory Shifts Under a Trump Administration

- A pro-business, deregulatory environment may encourage builders to break ground, especially if federal lands are opened for development or regulations are eased. Over time, this could address chronic supply shortages.

- However, tariffs and stricter immigration policies could raise labor and material costs, offsetting some of the benefits. The construction industry’s ability to ramp up production efficiently will be a key factor influencing long-term affordability.

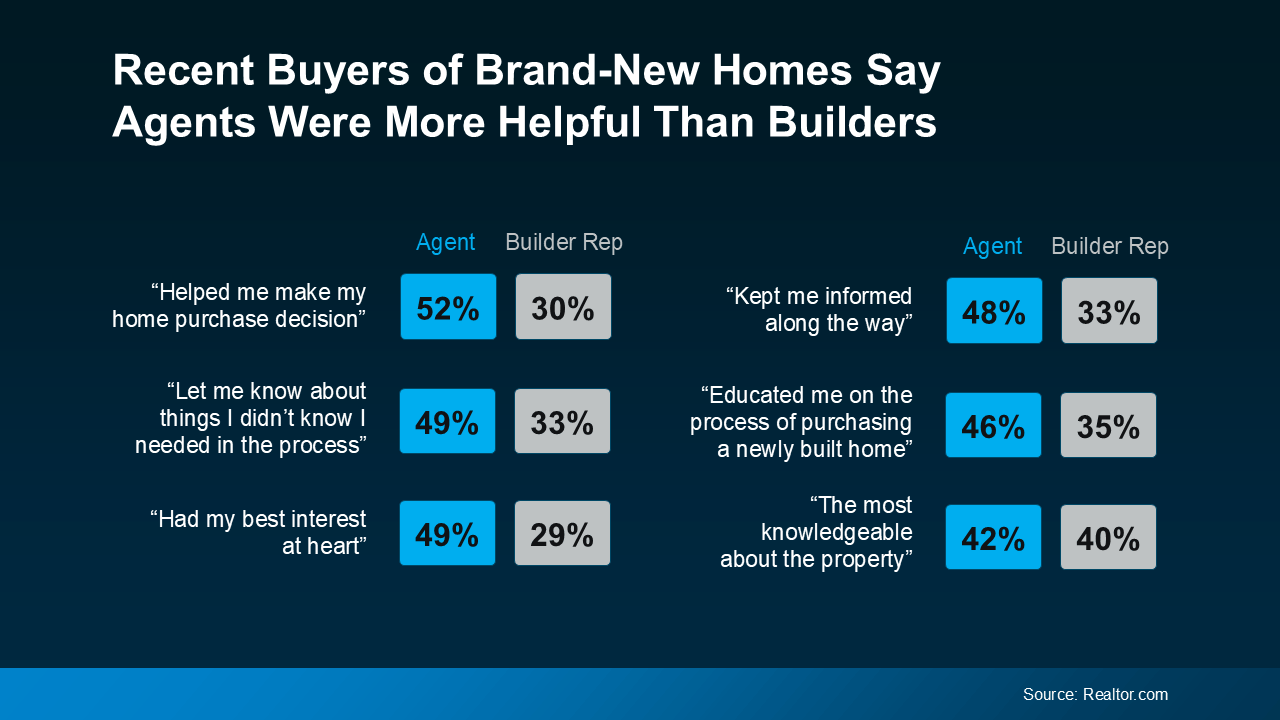

7. Market Consolidation & Commission Transparency

- Under new rules from the National Association of Realtors® and a more merger-friendly regulatory stance, we may see brokerages, lenders, and title companies combine forces. Expect a more consolidated industry with new pricing structures.

- Buyers and sellers will navigate a more transparent commission environment, negotiating fees with agents upfront. This clarity could lead to slight commission declines, especially at the luxury level.

8. Climate Risks Shape Regional Markets

- Properties in hurricane-prone Florida, wildfire-threatened California, and other high-risk regions may see slower price gains or declines as buyers factor in insurance and rebuilding costs. Climate awareness is hitting home values as buyers become savvier about risk.

- More resilient regions in the Midwest and Northeast could draw climate-conscious buyers seeking stable environments.

9. Cities on the Mend

- Pro-business and pro-housing policies in cities like San Francisco and L.A., plus improvements in public safety and ADU-friendly regulations, may revitalize urban cores. Self-driving vehicles and better public transit could improve commutes, making downtown living more appealing again.

10. Gen Z Delays Homeownership

- Younger buyers face steep hurdles. High rates, rising prices, and stiff competition from older, equity-rich buyers may keep many Gen Zers renting longer or living with family.

- As a result, smaller, more affordable homes get snapped up by downsizing Boomers or move-up buyers, while many first-timers remain on the sidelines, building savings in non-housing assets.

Wild Cards to Watch

- Mortgage Rates & Policy Moves: Unforeseen shifts in economic policy, inflation, or global trade could move rates unexpectedly.

- Trump’s Housing Agenda: If the administration’s proposals to lower costs and boost supply materialize, affordability could improve. But tariffs, reduced immigration, and deficits could create inflationary pressures and drive rates higher.

What It Means for You

- Buyers: 2025 offers a bit more breathing room. Inventory is higher, price growth is slower, and competition is less intense than in the pandemic frenzy. Still, plan for rates around the mid-6% range and budget accordingly.

- Sellers: Homes will still sell—if priced correctly. With more inventory and steadier rates, expect fewer bidding wars but a healthy stream of qualified buyers, especially in stable, well-located markets.

- Renters: With rents holding steady, it’s a good time to save toward a down payment if homeownership is a long-term goal. Flexible work arrangements and southern markets may offer more wallet-friendly options.

As we head into 2025, the housing market will be shaped by a complex interplay of political decisions, economic fundamentals, and demographic shifts. While uncertainty remains, one thing is clear: being informed, prepared, and adaptable will be key to navigating these changing conditions—whether you’re buying your first home, selling a long-held property, or simply weighing your options in a rapidly evolving market.

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "